When I was in 5th grade, my class took a mid-fall field trip to a farm deep into the hills of a local river valley. As we hiked through the Midwestern wooded forest learning about the different trees and woodland critters living in harmony within the ecosystem, we came upon the rotting carcass of a large stag. The stag’s size suggested that it had feasted mightily on the forest’s foliage, nuts, and berries to the detriment of other animals. It may have become so large that it began rotting prior to death and largely collapsed under its own weight after growing sick and possibly attacked by smaller creatures. The carcass appeared to be at least a few months old having started its decomposition during the high heat and humidity of late summer. As such, we were overcome by its acrid and pungent smell. The sharpness of the fetid odor wafting in our direction made many of us cover our faces choosing suffocation in desperate hope of preventing any further assault on our senses. Thankfully, our teacher quickly continued the class hike allowing us to once again breathe the clean, crisp forest air as we left the rotting carcass behind.

I’ve been smelling that foul, rotten odor once again and wondering if we’ll get to move past the rot.

The Gilded Age: Big Tech’s Home Looks Alluring But Do Not Be Deceived

Despite its glistening and lustrous appearance, Big Tech’s stench is suffocating all of us. San Jose, California (pictured above) sits squarely in Silicon Valley - home to Big Tech. As the tech economy has grown, San Jose has surpassed San Francisco to become the largest city in the Bay Area and third largest city in California with a population over 1,000,000, while Silicon Valley’s economy has become synonymous with software/app development. San Jose is home to numerous corporations such as eBay, Cisco Systems, Adobe, PayPal, Netgear, and Zoom while many other companies have substantial facilities there. Nearby or in San Francisco, you’ll find the headquarters for better known Big Tech companies such as Apple, Google, Meta and Twitter - sometimes known as commercial surveillance companies.

With Silicon Valley powering the local economy, the Bay Area - a region once known for its artistic, progressive culture centered on San Francisco - has been launched into the economic stratosphere. Culturally and economically, Silicon Valley is the Bay Area (including San Francisco) with some of its residents benefiting mightily. The average local salary at top tier tech employers is north of $200,000, although Twitter runs a bit lower. Entry-level software engineers may start in the mid-$100,000s with stock options but cap out at $600,000 as they reach senior status. Product Managers at top companies may start at $200,000, but senior Product Managers may command salaries in the $300,000-500,000 range with stock options. Many of these positions include fully-paid health insurance premiums, free meals at work, ample paid time off, and far more reasonable working hours when compared to other highly-paid professionals in healthcare or Big Law. With each IPO, Silicon Valley mints new millionaires and billionaires because of stock options.

Generous compensation packages and challenging work while residing in the temperate climes of the Bay Area with nearby access to all sorts of outdoor amenities - what’s not to love?

Once you scratch beyond the gilded surface of the Bay Area, you will begin to see the rotting carcass. Despite astronomical economic growth, well-paid tech workers with substantial discretionary income, and generous state benefits for those in need, the Bay Area’s homeless population continues to skyrocket. Homelessness isn’t limited to the under-served or historically discriminated parts of San Francisco or Oakland. The problem spans the FIVE COUNTIES surrounding Silicon Valley that contain San Francisco, Berkeley, Oakland, and all of suburban-ish Silicon Valley (including San Jose). A recent Mercury News article stated (emphasis added):

A flood of federal and state pandemic funding paid for everything from hotel rooms and tiny homes for unhoused people to rental relief for households falling behind on their bills. But even with those extra resources, people continued to become homeless faster than they could be housed. And as many pandemic programs end, local officials worry funding will dry up and they’ll struggle to continue the progress they’ve made in getting residents off the streets.

The problem is so widespread and severe that tent encampments under mass transit tracks, in parks, and on interstate off/on-ramps must be regularly cleared out. In fact, a massive 200-person encampment in Oakland is slated to be cleared after a large fire swept through it. Cities in suburban-ish Silicon Valley have considered or enacted ordinances targeting RVs that have permanently parked along their streets, including in Mountain View - home to Google. The South Bay, which largely encompasses Silicon Valley, continues to deal with rapid growth in chronic homelessness. The Bay Area cities are playing musical chairs with the homeless as they wander from city to city until forced to move again.

While homelessness has always existed across our nation, including in large cities like New York and Chicago, that has been, for better or worse, a set of policy choices centered around government benefits, minimum wage, and job access along with societal ills like racism and classism. This is very different. The current problem is jaw dropping given the breadth and depth of homelessness across California (and the Bay Area) - a very resource abundant and spacious state of 40 million with the 5th largest economy in the world, some of the most generous government benefits, a high minimum wage, and a booming job market.

The problem in the Bay Area has resulted in a lack of housing despite high demand from its affluent workforce. In the Bay Area, Marc Andreessen and his neighbors in the ultra-wealthy enclave of Atherton, CA are a prime example of the problem. Atherton is an exclusive Silicon Valley suburb in San Mateo county whose residents include Sheryl Sandberg (of Meta), Eric Schmidt (of Google), and other notables. Andreessen, co-founder of Netscape and current general partner at Andreessen Horowitz1 (a venture capital firm), explicitly stated: “[w]e can’t build nearly enough housing in our cities with surging economic potential — which results in crazily skyrocketing housing prices in places like San Francisco, making it nearly impossible for regular people to move in and take the jobs of the future.” However, when Atherton attempted to permit multi-family housing in order to alleviate California’s deficit of nearly 1,000,000 homes(!), Andreessen (and his neighbors) vehemently lodged his “IMMENSE” objections because it would “MASSIVELY” decrease his property value.

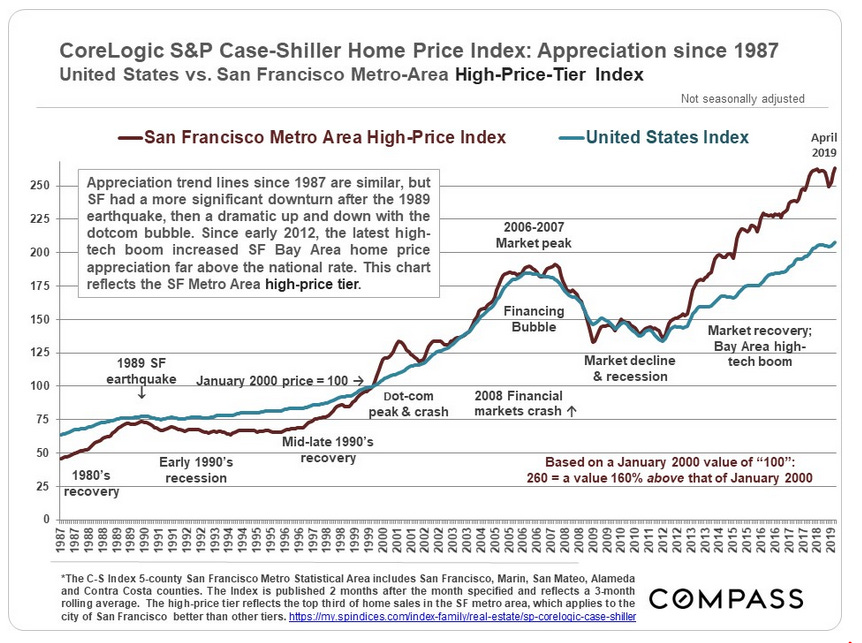

Based on the trend line of the index above, Bay Area home values have far outpaced the national average since 2012. It is difficult to imagine that adding a few multi-family homes would decrease home values within an exclusive ultra-wealthy suburban enclave. As I discussed here, Andreessen and his neighbors effectively threatened litigation with their deep pocketbooks and successfully scuttled the town’s plans for multi-family housing. The problem is not limited to small exclusive enclaves. The problem exist any time anyone wants to build more housing or re-zone for more density. In the Bay Area, home ownership is so lucrative that 10% of San Francisco’s housing stock is sitting empty despite high demand for housing.

The problem may be spreading across the West to Seattle (“Since 2014, Seattle has had a booming economy filled with high-wage jobs due to its technology industry.”) and Denver (“Tech workers priced out of Silicon Valley, he said, have been steadily migrating to Phoenix, Salt Lake City, Boise and Denver”) where tech workers have relocated for more affordability or other tech jobs only to drive up the cost of housing for locals.

Can you see the rot? Are you suffocating yet? Jack Dorsey appears to see it, maybe.

Big Tech’s Robber Barons: Titans of Commercial Surveillance

Recently, Peiter Zatko (aka Mudge), a well-respect hacker and former Twitter security lead, blew the whistle and laid bare for the world to see the rot at Twitter. As the redacted whistleblower complaint to Congress makes clear, Zatko was then CEO Jack Dorsey’s handpicked change agent to fix Twitter’s data security and privacy failures beginning in November 2020. The leadership and governance failures (discussed on Twitter here) that led to Mudge’s whistleblower complaint (excerpts in screenshots below) are emblematic of Big Tech’s commercial surveillance operations.

Prior to Zatko’s employment, Twitter had an embarrassing history of failures including a 2011 FTC consent order directing implementation of a data privacy and security program; a July 2020 hack where teenagers simply obtained employee passwords over the phone by pretending to be Twitter I.T.; and a July 2020 FTC complaint (leading to a $150 million fine) alleging violations of the 2011 FTC consent order when Twitter misused user phone numbers and emails that were obtained for security purposes.

Despite this history of failures, Zatko’s noble efforts to drive change at Twitter were stymied from top to bottom. Immediately, Zatko discovered that Twitter had made virtually no progress towards complying with the 2011 FTC consent order and had no plans to achieve compliance. Zatko’s attempts to identify data security problems were met with denial and hostility by the senior executive team, especially then CTO (and later CEO) Parag Agrawal. The senior executives preferred to maintain the status quo due to arrogance and/or a perverse bonus structure that awarded bonuses up to $10 million. At other times, Board Members appeared to stick their heads in the ground or feign shock when alerted to Twitter’s failure to comply with the 2011 FTC consent order despite a near decade of (failed) oversight by them. Zatko also expressed concerns about foreign governments doxxing VPN users (China) and infiltrating as employees (India). Twitter is a highly dysfunctional and broken company.

As Jack Dorsey withdrew from Twitter and eventually resigned as CEO in November 2021 (one year after recruiting Mudge), Zatko appeared to be left without any help to drive change at Twitter. Agrawal ascended to CEO and continued misleading the Board regarding Twitter’s data security and privacy program. Simply put, a culture of “deliberate ignorance” existed to preserve the status quo despite the history of failures. Put another way, prior FTC regulatory action and litigation risks were woefully insufficient to change the risk-reward analysis for Twitter’s executives, Board Members, and shareholders.

On the surface, Twitter provides a micro-blogging platform so that its users can express themselves and easily connect with other like-minded individuals. Behind the scenes, Twitter is a data collection and advertising company - sometimes known as commercial surveillance. It collects data about its users that allows it to sell user-targeted ads to advertisers. Its ability to sell targeted ads turns on user engagement with the platform. More users engaging on the platform more often means more data collection and advertising opportunities. In 2021, Twitter generated $5.1 billion in revenue with a net loss of $221.4 million that included a one time litigation-related charge of $756.7 million. In 2021, Meta posted a net income of $10.28 billion, while Google posted a net income of $76 billion. Like its fellow commercial surveillance companies, Twitter generates the bulk of its revenue from advertising. Commercial surveillance is extremely lucrative. These companies, executives, and shareholders (including employees with stock options) are benefiting mightily.

As of late, former CEO Jack Dorsey, who expects to leave Twitter’s Board of Directors in November, has expressed regrets about what Twitter has become. In April 2022, three months after Mudge’s firing, Dorsey expressed regret regarding creating a centralized internet where Twitter, Meta, Amazon, and Google claim an outsized proportion of users and their data. Dorsey went on to decry the “like” button that perpetuates salacious content and to indicate that he would like to see algorithmic transparency. Shortly before Dorsey’s public regrets, Elon Musk, on March 26, 2022, initiated talks with Dorsey to join Twitter’s Board that instead culminated in a $44 billion purchase agreement (or $54.20 per share) to take the company private. Currently, Twitter’s stock price of $41.74 per share (as of September 13, 2022) remains well below the agreed upon purchase price, while Musk seeks to terminate the purchase agreement as a result of the allegedly misleading statements made in Twitter’s SEC filings and the substantial litigation risk resulting from Mudge’s whistleblower complaint. These litigation risks potentially include regulatory action by the FTC and SEC as well as shareholder lawsuits. It remains unclear how this will play out, but Twitter may need to reorganize or determine whether it can continue as an ongoing concern.

Unlike Jack Dorsey, Meta’s Mark Zuckerberg appears to be mostly continuing business as usual. Meta, like Twitter, has been operating under a 2012 FTC consent order requiring a comprehensive privacy program and biennial audits. Like Twitter, the FTC, subsequently, has taken action against Facebook (now Meta) for the Cambridge Analytica scandal that resulted in a whopping $5 billion settlement. The Cambridge Analytica scandal involved Facebook wrongfully providing access to user data that may have allowed for psychological targeting of U.S. voters and potentially undermining the integrity of our elections. It appears that Meta may have overpaid in that settlement in order to keep Zuckerberg from being named in the suit or having to sit for a deposition. Meta also appears to be settling the civil lawsuit arising from the Cambridge Analytica scandal well before the motion for class certification and before the close of discovery in order to spare Sheryl Sandberg and Zuckerberg from having to sit for a deposition - again(!). Sheryl Sandberg officially resigned as Meta’s Chief Operating Officer on August 1, 2022, but remains on Meta’s Board of Directors. Despite Meta’s history of failures including the Rohingya genocide and Cambridge Analytica scandal, Zuckerberg appears to be embarking on a public relations tour that began with Joe Rogan’s podcast as his role at Meta expands.

Can you smell the stench of rot coming from Big Tech? Do you see what the problem is? If not, here’s a hint courtesy of DuckTales (a woo hoo!).

Yep, Big Tech’s commercial surveillance operations, including their shareholders, are in the clutches of gold fever. I wouldn’t be surprised if Tech workers would push their own mothers down a flight of stairs for one more gold nugget.

The Great Awakening: Where’s the Big Stick?

Over the past several years, privacy advocates - and eventually the public - have awakened to the harms that commercial surveillance has wrought upon us, but too many others fail to see that serious action is necessary to change the risk-reward calculus for these companies. As our lives have become awash in data collection, there has been increasing evidence that commercial surveillance companies are causing substantial harm including damaging teenagers’ mental health, spreading disinformation that is polarizing our society, and enabling the criminalization of abortion. Yet, many continue to advocate for a more measured approach. Instead, we need the Chicago Way.

The American Data Privacy and Protection Act (ADPPA), a bipartisan and bicameral data privacy and security bill, potentially reflects a momentous legislative achievement that could signal a uniform national legal framework for the nation. Numerous civil rights organizations and privacy experts have come out in support of ADPPA indicating that Democrats - Speaker Nancy Pelosi of California and Senator Maria Cantwell of Washington - should pass the bill now. However, ADPPA, as it is currently drafted, does not appear to meaningfully change the risk-reward calculus for commercial surveillance companies because it lacks serious enforcement mechanisms like whistleblower or statutory damages provisions.

A decade or so ago, the FTC took a light touch with Twitter and Meta by seeking consent orders that implemented data privacy and security programs. Twitter and Meta deliberately ignored those consent orders because the subsequent litigation risks and financial repercussions pale in comparison to the financial windfall from unmitigated data collection. Both Twitter and Meta have faced subsequent regulatory actions from the FTC resulting in fines ($150 million and $5 billion, respectively) as well as reputational risks, but these do not appear to make a difference. During a September 13th Congressional hearing, Mudge testified that the FTC is outmatched when compared to Silicon Valley’s deep pockets. In fact, Mudge’s whistleblower complaint was key to shining the light on Twitter’s depth of failure at privacy compliance and total disregard for the FTC’s consent order all the way up to the Board of Directors. Otherwise, we may never have discovered the corporate malfeasance committed by the executives and Board of Directors.

Likewise, plaintiffs that have been victims of data breaches and data misuse struggle to maintain lawsuits against commercial surveillance companies. While plaintiff’s attorneys have come a long way over the past few years to demonstrate concrete injury arising out of data privacy breaches/violations, courts often continue to dismiss these cases for lack of standing and thus preclude accountability. However, Illinois’ Biometric Information Privacy Act (BIPA) contains a statutory damages clause that has largely allowed plaintiffs to successfully maintain standing for violations of BIPA and therefore to seek monetary damages. As such, statutory damages appears to be a critical factor in shifting the risk-reward calculus for commercial surveillance companies.

In 1987’s The Untouchables, screenplay by David Mamet, Jim Malone (Sean Connery) asks Eliot Ness (Kevin Costner): what are you prepared to do to get Al Capone? Malone then utters the famous lines (captured above) describing the Chicago Way. Chicago is a lovely place full of surprisingly friendly, extroverted big city folk. But, if you arrogantly cross a big fish, you will be put down quickly. Likewise, this is no time for gelding the lily or accepting small, inadequate wins - the FTC tried that a decade ago and it failed miserably. Those of us on the West Coast where commercial surveillance has created an industry that continues to consolidate power and generate societal harms - digitally and physically - know that any federal data privacy law that preempts state law MUST be a sledgehammer with a couple of grenades in reserve.

Even now, those who operate in the shadows of the commercial surveillance industry - data brokers - are ready to fight for their right to continue trafficking in data regardless of the harms created. Kochava, a shadowy data broker, has chosen to pursue a very aggressive and unusual legal strategy regarding the FTC’s inquiries by filing suit to challenge the FTC’s authority (one might argue this is arrogant). The current FTC, led by Chair Lina Khan, understands the importance of this fight and has also filed suit against Kochava. Most notably, the FTC’s complaint alleges that Kochava’s location data feed subscription allows for precise geolocation data of a unique devices and thus allows for de-identification. This is just the beginning.

What are you willing to do for your privacy?

The commercial surveillance companies have been raking in easy money for over a decade now. We, the users, have suffered harms - to our mental health, electoral integrity, reproductive freedoms, and simply, our privacy. The beast has grown fat to the detriment of other animals and plants in the ecosystem. Its rot is suffocating all of us, but it does not appear to show any signs of collapse. What are you going to do for your privacy, your society so that we can once again breathe that crisp, clean forest air because the beast is going to fight back with everything it has?

Andreessen Horowitz has recently opted to provide $350 million in venture capital for a real estate project by Adam Neumann whose gross mismanagement of WeWork included treating employees poorly, burning investor cash on booze and his wife’s vanity project, and the company’s value decreasing from $47 billion to $8 billion during his reign.